Do You Believe Family Cottages Should be Kept in the FAMILY?

We Do....

At Return On Life We Provide Insurance Solutions to Help Maintain Cottage Legacy. Join Us In Our Fund Your Future Webinar To Learn More!

Cottage Legacy Webinar

Date: 25th November 2024, Monday

Time: 7pm to 9pm ET

Location: ZOOM

Watch this video to learn how you can keep your family cottage in your family for GENERATIONS!

RISK FACTORS FOR KEEPING FAMILY COTTAGES

Capital Gains

Rising Property Taxes

Cottage Maintenance Costs

Family Dynamics

Usage Agreements

Securing A Cottage Mortgage

WHAT IS SPECIAL ABOUT THE COTTAGE

FAMILY

FRIENDS

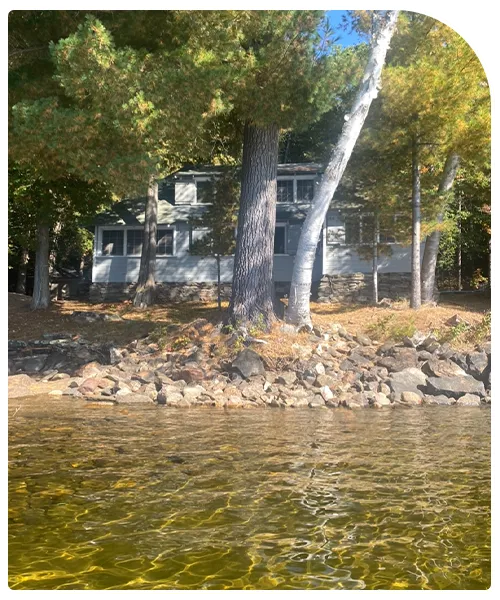

WATER

NATURE

The family cottage is a generational asset: the fabric of family values and memories.

FAMILY

FRIENDS

WATER

NATURE

WHAT’S THE PROCESS ?

1

FAMILY DISCUSSION

Uncovering Family goals: Formalizing and Aligning

2

ESTATE PLAN

Developing an Estate Strategy to Achieve Your Goals

3

FUNDING THE COTTAGE LEGACY

Financing Solutions for Sustainability of the Plan

OUR ROLE

At Return on Life, we understand what’s at stake - The cottage is a place rich with memories, appreciated by generations.

We guide a collaborative process, bringing together the right people and experts to identify what's needed to maintain the cottage

Family Meeting, Estate Plan and Financing are inclusive to the plan - to help family grow, protect and transition family cottages.

Cash Value Life insurance

Why is it a fit?

Acts as both a safety net and wealth-building tool. It grows tax-free to enhance long-term financial planning such as the inevitable Capital Gains on the family Cottage transition from one generation to the next.

Cash is in there?

Easily accessible like a savings account, it allows for withdrawals or loans for any financial needs such as taxes, maintenance or major items with a cottage.

How does it work?

Use it to secure loans like you would home equity, facilitating financial stability without having to sell other assets.. It offers tax-free growth and the freedom to use opportunistically.

Like any tool, you’ll need to learn how to use it - that is where we come in.